A day after the U.S Independence day, Bitcoin (BTC), the largest cryptocurrency by market capitalization, is up 5% over the past 24 hours and is currently trading at around $20,107, according to data from CoinMarketCap. Ethereum (ETH), the second-largest cryptocurrency, has gained 9% in the last 24 hours and is changing hands for around $1,148. The global cryptocurrency market capitalization is up 5.3% to $910.9 billion in the last 24 hours, suggests data from CoinMarketCap. [BITCOIN PRICE]

Read More »Ethereum [ETH] miners’ revenue check amid ‘Merge’ anticipation

Ethereum has continued to enjoy a fair share of dominance among the altcoins. That goes for miners as well. Ether miners in 2021 earned over $3 billion more than their Bitcoin counterparts. However, the positive narrative around ETH miners took a major blow this year. Are miners out? Well, the first thing is the much-anticipated Merge. The Merge would force Ethereum’s $19 billion mining industry to find a new home. This would shift Ethereum’s consensus mechanism from… Source link

Read More »Active Ethereum Addresses Touch 2020 Levels, Will Price Follow?

Ethereum active addresses have continued to decline. This follows the market crash where the price of Ethereum had dropped to below $1,000 before staging another recovery. This decline has shown various implications for the digital asset and also points towards how investors could be feeling towards the digital asset. Activity Falls To 2020 Lows Data from the Block shows that the active addresses on the Ethereum network on a seven-day basis are down. These active addresses had hit a new… Source link

Read More »Ethereum, Solana & Bitcoin – American Wrap 04 July

Why being an early buyer of the Solana price is unnecessary Solana price is one of the charts to consider observing from an academic standpoint but is still unfavorable for trading in the short term. It is quite uncertain where the SOL price wants to go next. Why lower gas fees is super bullish for the Ethereum price Ethereum price shows subtle signals that a bull rally could be underway. On July 4, 2022, the bulls are fighting neck and teeth to hold ground amidst… Source link

Read More »Why lower gas fees is super bullish for the Ethereum price

Ethereum price shows historically low gas fees. ETH price shows a bounce at a critical Fibonacci level. Invalidation of the uptrend is a breach below $878. Ethereum price could make a run for the 200-week moving average at $1,200 and then some. Here are the factors to keep in mind. Ethereum price could start pumping Ethereum price shows subtle signals that a bull rally could be underway. On July 4, 2022, the bulls are fighting neck and teeth to hold ground… Source link

Read More »Why Ethereum Scaler Arbitrum Hit Pause on Odyssey NFT Campaign

Decrypting DeFi is Decrypt’s DeFi email newsletter. (art: Grant Kempster) It can be difficult to extrapolate the precise differences between a good sustainable product and temporary financial incentives in the world of crypto. Crypto-native products are extremely clunky, asking users to jump through any number of weird hoops just to move a bit of money around. But if moving that money around means that you can earn even more money, then that product can enjoy enormous traction. DeFi offers… Source link

Read More »Ethereum Gas Fees Falls To Record Low, Price Consolidates Around $1,000

After reaching a level last seen in November 2020, the average Ethereum gas fee is now below $1. Ethereum Gas Fees Falls The Ethereum network experienced transaction fees as low as 69 cents on Saturday, which has not happened in the previous 19 months. The following day, gas prices reached $1.57 or 0.0015 ETH, which is equivalent to December 2020’s numbers. Transaction costs on the network today ranged from 20 cents to merely 20 cents, with 20 cents being the highest. Gas prices in the… Source link

Read More »What to Expect From Bitcoin and Ethereum in Q3 2022

Key Takeaways Bitcoin plummeted by 56% in Q2 2022. Meanwhile, Ethereum had a negative quarterly performance of 67%. Low trading volumes and open interest point to further losses in Q3 2022. Share this article Bitcoin’s status as a hedging asset was called into question in Q2 2022 after it suffered a steep drop in tandem with global financial markets. Ethereum has performed worse than Bitcoin with liquidity drying up across all major cryptocurrency exchanges. Low Liquidity Ahead… Source link

Read More »Ethereum Gas Fee Tanks to the Lowest Since 2020 as ETH Struggles at $1,000 – Coinspeaker

Ethereum gas fee plummets as NFT sales and DeFi activity on the platform are on a sharp decline over the last two months. The world’s second-largest cryptocurrency Ethereum (ETH) has been under severe pressure recently. As of press time, ETH is struggling to hold above $1,000 levels. Amid the bearish conditions, the Ethereum network gas fee has dropped to the lowest since 2020 to 0.0015 ETH or $1.57. The last time the ETH gas fee was this low was in December 2020. Last year, the ETH gas fee… Source link

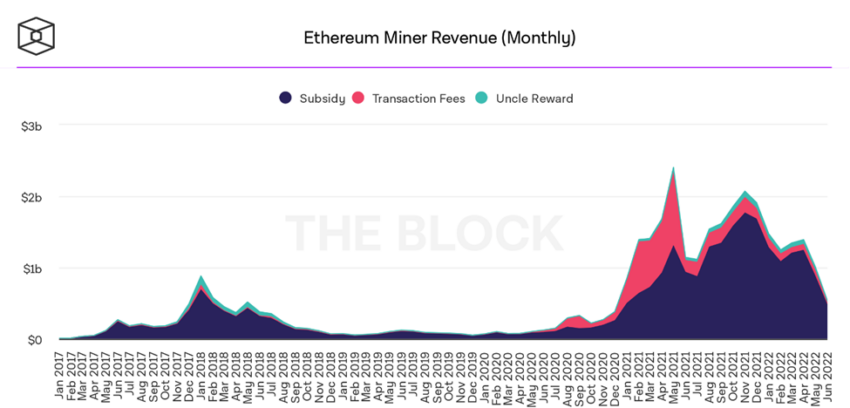

Read More »Bitcoin Miner Revenue Surpasses Ethereum by More Than $100M; Both Crash to 2022 Lows

Bitcoin and Ethereum miners saw a further decline in revenue as bears from May carried on throughout June and led to sinking prices of both cryptocurrencies. June proved to be the worst month for Ethereum miners in 2022. According to Be[In]Crypto Research, ETH miners were able to generate around $549.58 million in revenue in the sixth month of the year. Source: Ethereum Miner Revenue Chart by the Block Crypto Ethereum miners’ revenue for June was down $460.42 million from May 2022’s… Source link

Read More »